The company pioneered the global delivery model for IT services with their first offshore client in 1974.In the year 1981, the company set up Indias first IT R&D division, the Tata Research Design and Development Centre at Pune. In the year 1971, they started their first international assignment. Tata Sons Ltd established the company as division to service their electronic data processing (EDP) requirements and provide management consulting services. The company shares are listed on the National Stock Exchange and Bombay Stock Exchange of India.Tata Consultancy Services Ltd was incorporated in the year 1968. They are having 142 offices in 42 countries as well as 105 delivery centers in 20 countries. The company is a part of Tata Group, one of Indias most respected business conglomerates and most respected brands. Their segments include banking, financial services and insurance manufacturing retail and distribution, and telecom. They also offer IT infrastructure services, business process outsourcing services, engineering and industrial services, global consulting and asset leveraged solutions. The company offers a range of IT services, outsourcing and business solutions. Tcs Share Price, Tata Consultancy Services Ltd is a leading global IT services, consulting and business solutions organization. The target price implies an upside of 20% from today’s low.Industry: Information Technology Services Improved demand environment over next 2-3 years with stable margin and industry-leading return ratios would support current valuation,” Yes Securities said. “Robust deal booking and growing share of digital revenue provide strong visibility about revenue and margin outlook. Yes Securities – Buyįocusing on the positives, analysts at Yes Securities highlighted that TCS has maintained operating margin in a tough environment. We cut our Fair Value by 3% while maintaining our ADD rating, valuing the stock at 32X September 2023E EPS,” they said. “TCS is better-positioned than peers to manage margin headwinds and participate in accelerated transformation spending. However, the brokerage firm said that the Revenue growth outlook remains undimmed by recent underperformance. Kotak Securities – AddĪnalysts at Kotak Securities highlighted that TCS missed their estimates due to a surprising moderation in growth in Continental Europe. The target price implies an upside of 25% from today’s low. “We expect TCS to continue to command valuation premium to its large-cap peers, on the back of its strong diversified profile, superior return profile (ROE of 38%), management stability and market leadership position,” they added. However, they added that they expect a strong performance in the coming quarters, and continue to believe that TCS can emerge stronger. The brokerage firm said that although TCS had a moderate quarter, investors are expected to be disappointed. The stock has today slipped below the target price set by Motilal Oswal. A miss on estimates in the second quarter, coupled with a soft margin outlook, can result in near term pressure on the stock,” they said. But high valuations leave limited room for disappointment. “We remain positive on the company, given its strong growth outlook. Should you buy or sell? Motilal Oswal – NeutralĪnalysts at Motilal Oswal said that although TCS reported in-line revenue growth, the USD revenue growth missed estimates. At the closing bell on Friday, TCS market cap was at Rs 14.55 lakh crore, however, on Monday morning the same was close to Rs 13.7 lakh crore. Today’s massive drop in the stock price has erased nearly Rs 1 lakh crore in market capitalization for TCS.

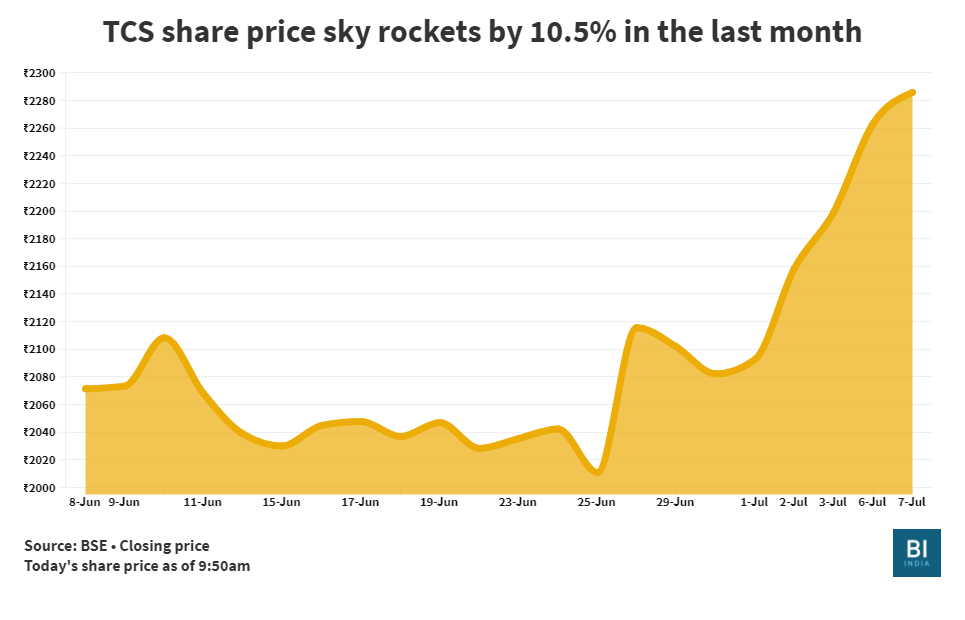

So far this year, TCS share price is up 27%. Earnings before interest and taxation (EBIT) margins improved during the quarter to 25.6% from 23.2% earlier last year. Revenue of the company improved 16.8% from the previous year to Rs 48,867 crore. The IT major reported a net profit of Rs 9,624 crore during the previous quarter. The Tata Group company has also approved an interim dividend of Rs 7 per equity share for its shareholders. On Friday, TCS reported a 29% on-year growth in consolidated net profits for the July-September quarter. The IT major was the worst-performing stock on S&P BSE Sensex, while the benchmark index was nearing all-time highs. TCS share price hit an intra-day low of Rs 3,660 per share, 6.9%. TCS ( Tata Consultancy Services) share price tanked nearly 7% on Monday morning as investors reacted to the quarterly results of the second most valuable listed company in India.

0 kommentar(er)

0 kommentar(er)